|

Getting your Trinity Audio player ready...

|

In a long-anticipated move, the Federal Reserve took action this week, raising interest rates to their highest level in over 22 years. This pivotal decision is set to have far-reaching consequences for businesses and the economy, raising questions about the future direction of monetary policy and its effects on financial markets and consumer behavior.

The Fed's Bold Move: Financial Markets React

With financial markets already factoring in the interest rate hike, the Federal Open Market Committee (FOMC) increased the funds rate by a quarter percentage point, landing at a target range of 5.25% - 5.5%. As the benchmark rate approaches levels last seen in early 2001, businesses and investors alike are closely watching the potential implications.

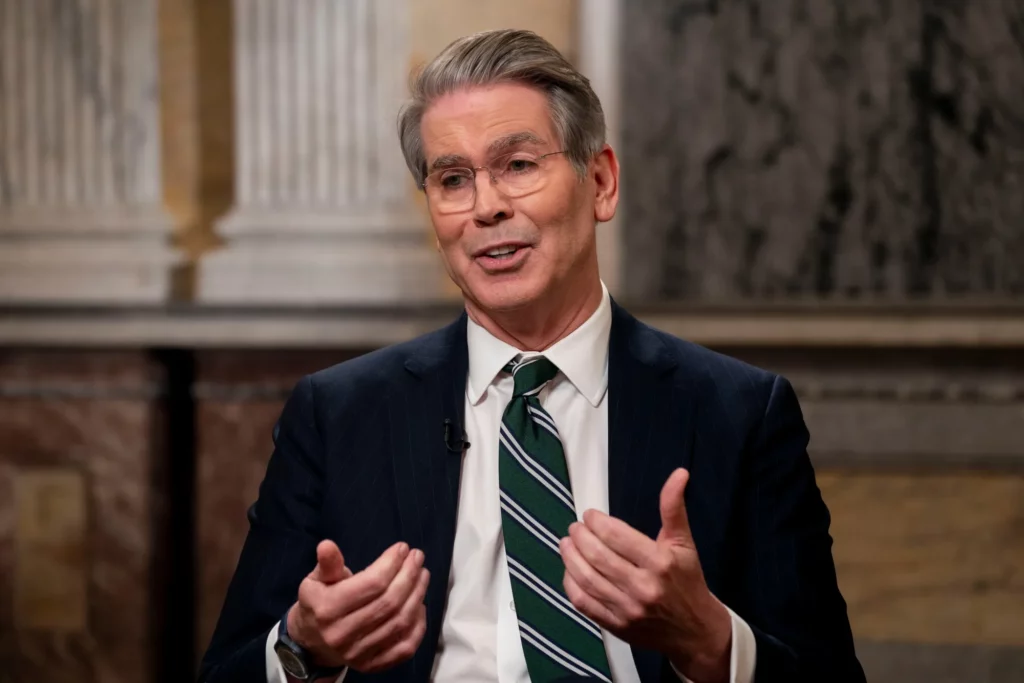

While the June meeting indicated the likelihood of two more rate increases in the year, markets have been questioning whether the Fed will indeed take that path. During a news conference, Chairman Jerome Powell hinted at a measured approach, indicating that the FOMC would assess incoming data and its impact on economic activity and inflation before making any further moves.

The Borrowers' Burden: Higher Costs and Uncertain Prospects

For borrowers, the consequences of the rate hike are evident. Loans for major expenses, such as homes, cars, and higher education, are becoming more costly. Credit card holders may also find themselves facing even higher interest payments, as credit card rates are closely tied to the Federal Reserve's moves.

Notably, the average credit card interest rate currently stands at a staggering 20.5%, leading to increased financial strain for those carrying balances.

Mortgages, in particular, have seen a significant impact. With rates surpassing 7%, borrowing for homes has become notably pricier compared to the 3.22% rate at the start of 2022. Homebuyers could face additional costs of thousands or tens of thousands of dollars per year, depending on the property price.

Nevertheless, economists anticipate the higher rates to curb demand and potentially lead to a cooling effect on home prices.

The Savers' Advantage: Yield Gains and Inflation Protection

On the other side of the equation, savers can find a silver lining amidst the rate hike. Yields on savings accounts have risen as the Federal Reserve adjusted its rates, offering depositors an opportunity to earn more on their savings.

High-yield savings accounts have also emerged, boasting returns of up to 5% annual percentage yield, providing an attractive option for those seeking higher returns.

Moreover, the elevated interest rates, alongside declining inflation, provide added protection for savers. With inflation rates moderating, the risk of consumer prices eroding savings is diminished, allowing savers to retain more of their earnings.

As the Federal Reserve's tightening process progresses, businesses, consumers, and investors will be closely monitoring how the economy responds. While borrowers face increased costs, savers have the chance to benefit from higher yields and inflation protection.

As the financial landscape continues to evolve, businesses must remain agile and adaptive to navigate the impact of this historic interest rate hike effectively.