|

Getting your Trinity Audio player ready...

|

In recent months, the U.S. economy has witnessed a significant surge in long-term Treasury yields, posing both challenges and opportunities. This increase, particularly notable in the 10-year Treasury note, directly impacts interest rates on credit cards, mortgages, and auto loans, making borrowing more costly.

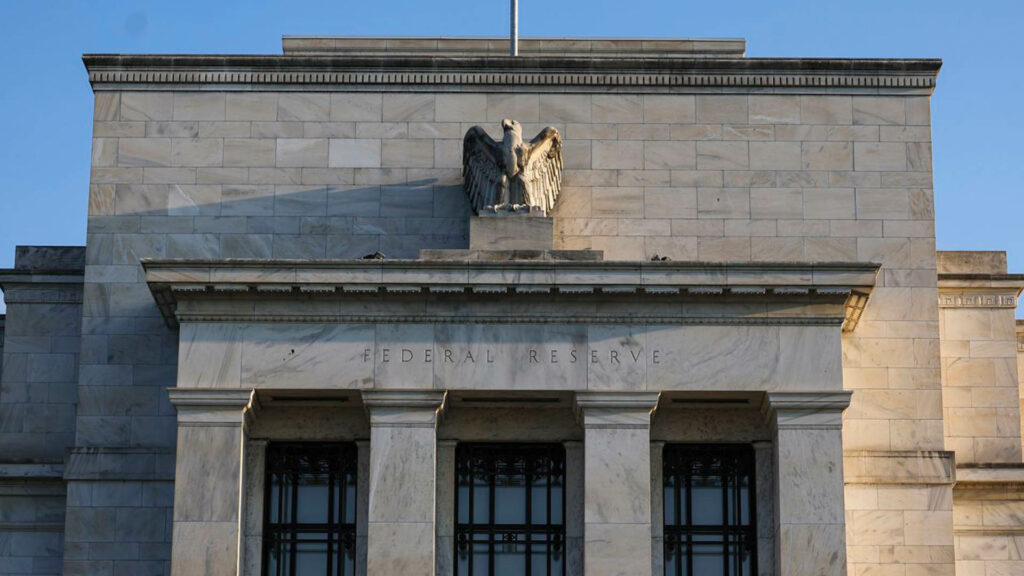

Such a shift serves as a balancing act for the Federal Reserve (the Fed), simultaneously checking inflation and increasing government borrowing costs.

The Fed's Delicate Balancing Act

While investors grapple with the downturn in their portfolios due to these yield spikes, the Fed has found some breathing room. Higher yields have eased the immediate need for rate hikes, allowing time for more comprehensive economic data analysis.

In a recent post-meeting press conference, Fed Chair Jerome Powell acknowledged the intricate dance of managing these yields without pinpointing their exact drivers. He emphasized the consequential impact of these higher borrowing costs on households and businesses, foreshadowing potential economic slowdowns if such tightness persists.

A Tactical Pause in Rate Hikes?

Acknowledging these market dynamics, the Fed hints at a possible shift in its approach. Notably, Kathleen O’Neill Paese, the interim president of the St. Louis Fed, supported maintaining steady rates in the November meeting, citing tightened financial and credit conditions reflected in higher long-term Treasury yields.

This strategic pause, however, remains contingent on the volatile nature of bond yields, which have shown tendencies to fluctuate unexpectedly.

Market Reactions and Unintended Consequences

The market's response to these shifts further complicates the scenario. A recent announcement by the Treasury Department about a smaller-than-expected debt auction, coupled with Powell’s remarks, fueled beliefs that the Fed might halt rate hikes.

Such perceptions, as analysts like John Madziyire from Vanguard and Joe Kalish from Ned Davis Research observe, could lead to lower yields and unintended economic stimulations, such as a drop in mortgage rates, which could counteract the Fed's inflation control efforts.

The Fed's Firm Stance Amidst Market Speculations

Addressing these market speculations, Powell firmly reiterated the Fed’s commitment to its inflation targets, hinting at the possibility of further policy tightening if necessary.

His comments at an International Monetary Fund conference underscored the ongoing struggle against inflation and the potential need for a more hands-on approach by the Fed, rather than relying solely on bond yield movements.

The Road Ahead: A Balanced Approach

As the Fed navigates these complex economic waters, it acknowledges the need to balance its responses to financial tightening. This delicate interplay between market signals and policy actions underscores the critical role of the Fed in steering the economy toward stability while managing inflation and market expectations.

In conclusion, the evolving bond yield landscape presents a unique challenge for the Federal Reserve, requiring a nuanced approach that balances market dynamics with policy objectives. As we move forward, the Fed's decisions will continue to be a focal point in shaping the economic trajectory amidst these fluctuating financial conditions.